Introduction

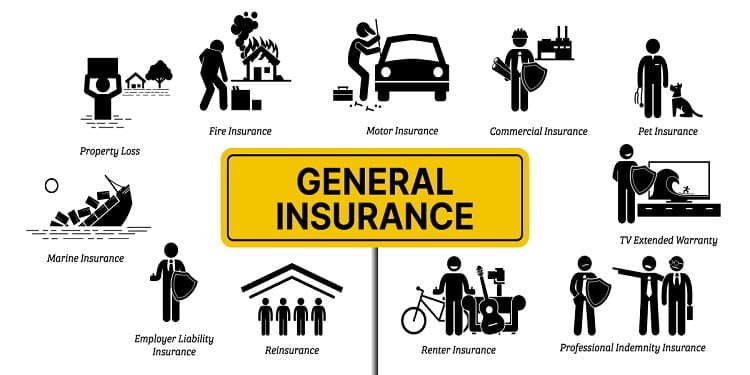

General insurance plays a crucial role in protecting individuals and businesses from various risks and uncertainties. In India, there are several insurance companies offering a wide range of general insurance products. In this article, we will explore the top 10 general insurance companies in India, based on their reputation, customer service, product offerings, and financial strength.

1. New India Assurance Company Limited

New India Assurance Company Limited is the largest general insurance company in India. It offers a comprehensive range of insurance products, including motor, health, travel, home, and commercial insurance. With its wide network of branches and excellent customer service, New India Assurance has established itself as a trusted name in the insurance industry.

2. National Insurance Company Limited

National Insurance Company Limited is one of the oldest general insurance companies in India. It offers a diverse range of insurance products, including motor, health, personal accident, and property insurance. The company has a strong presence across the country and is known for its prompt claim settlement process.

3. Oriental Insurance Company Limited

Oriental Insurance Company Limited is another leading general insurance company in India. It provides a wide range of insurance products, such as motor, health, travel, and property insurance. Oriental Insurance is known for its competitive premiums and efficient customer service.

4. United India Insurance Company Limited

United India Insurance Company Limited is a government-owned general insurance company. It offers a comprehensive range of insurance products, including motor, health, travel, and commercial insurance. The company has a strong presence in both urban and rural areas, making it accessible to a wide range of customers.

5. ICICI Lombard General Insurance Company Limited

ICICI Lombard General Insurance Company Limited is a leading private sector general insurance company in India. It offers a wide range of insurance products, including motor, health, travel, and home insurance. ICICI Lombard is known for its innovative products and customer-centric approach.

6. Bajaj Allianz General Insurance Company Limited

Bajaj Allianz General Insurance Company Limited is a joint venture between Bajaj Finserv Limited and Allianz SE. It offers a diverse range of insurance products, including motor, health, travel, and home insurance. The company has a strong presence in both urban and rural areas, making it accessible to a wide range of customers.

7. HDFC ERGO General Insurance Company Limited

HDFC ERGO General Insurance Company Limited is a joint venture between HDFC Ltd. and ERGO International AG. It offers a comprehensive range of insurance products, including motor, health, travel, and home insurance. The company is known for its quick claim settlement process and customer-friendly approach.

8. Reliance General Insurance Company Limited

Reliance General Insurance Company Limited is a subsidiary of Reliance Capital Limited. It offers a wide range of insurance products, including motor, health, travel, and home insurance. The company has a strong distribution network and is known for its competitive premiums.

9. Tata AIG General Insurance Company Limited

Tata AIG General Insurance Company Limited is a joint venture between Tata Group and American International Group, Inc. It offers a diverse range of insurance products, including motor, health, travel, and home insurance. The company is known for its innovative products and efficient claim settlement process.

10. SBI General Insurance Company Limited

SBI General Insurance Company Limited is a joint venture between State Bank of India and Insurance Australia Group. It offers a comprehensive range of insurance products, including motor, health, travel, and home insurance. The company has a strong presence in both urban and rural areas, making it accessible to a wide range of customers.

Conclusion

These are the top 10 general insurance companies in India, offering a wide range of insurance products to cater to the diverse needs of individuals and businesses. When choosing an insurance company, it is essential to consider factors such as reputation, customer service, product offerings, and financial strength. By selecting a reliable and trustworthy insurance provider, you can ensure that you are adequately protected against various risks and uncertainties.